Americans are proving remarkably reliable in how they are spending their federal stimulus payments.

The New York Federal Reserve released a study this week showing that Americans are using most of the money for paying down debt and for savings, with a smaller portion going to actual spending.

Households, on average, are using, or plan to use, 41.6% of the latest relief payment toward savings, 33.7% toward debt and 24.7% for spending, according to the report.

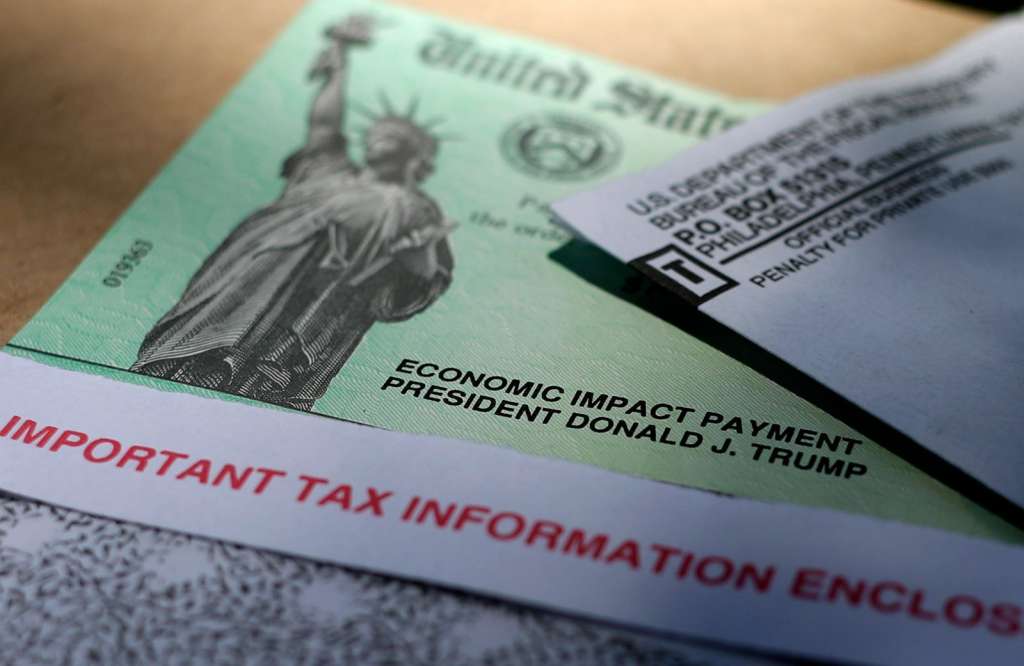

The latest round of government payments — $1,400 to individuals __ were sent out beginning last month.

The percentage for each category has stayed relatively stable for each of the three rounds of payments. Although the percentage used for spending declined slightly each round — moving from 29% in the first to 26% in the second and 25% in the third. Savings rose with each relief payment round.

Researchers found there were variations by income level: Lower-income households tended to use more of the money for debt or spending than higher-income counterparts.

The authors said that their findings suggest that consumers may be choosing to spend less because of restrictions that inhibit spending, continued high unemployment and uncertainty about the duration and full economic impact of the pandemic. As the economy reopens and fear and uncertainty recede, the authors said the high levels of saving should facilitate future spending.

(Copyright (c) 2024 The Associated Press. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed.)