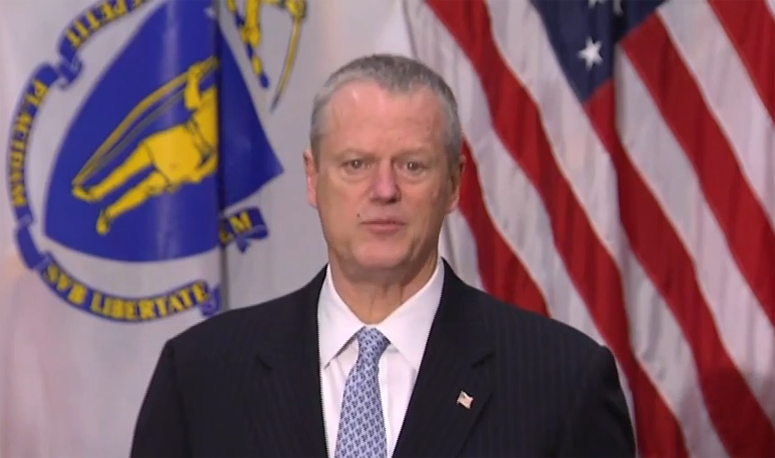

In the wake of a new report warning about a “fiscal calamity” approaching the MBTA, Gov. Charlie Baker voiced his criticism of a proposed income surtax on wealthy households set to go before voters next year, questioning how much money the idea would generate and what those revenues might be spent on.

Baker said Thursday that he is not reconsidering his opposition to the proposal, cautioning that its passage could prompt high-income residents or businesses to leave Massachusetts and questioning whether it could earmark revenue for transportation and education needs as supporters intend.

“If we’ve learned anything over the course of the past 18 months, and it certainly showed up in our future of work study, people can work from anywhere,” Baker told GBH’s “Boston Public Radio” in an interview. “Companies can locate anywhere, and many of them can be just as successful working that way as they were once upon a time when everybody went to the office and everybody lived in the same place.”

“We should be very careful about that as we think about things like how much we think we might raise from something like the Fair Share tax,” Baker, a Republican, added.

The proposed constitutional amendment (S 5) would impose a 4 percent surtax on annual household income over $1 million. The proposal states that “to provide the resources for quality public education and affordable public colleges and universities, and for the repair and maintenance of roads, bridges and public transportation, all revenues received in accordance with this paragraph shall be expended, subject to appropriation, only for these purposes.”

Supporters have estimated it could bring in as much as $2 billion per year, providing a jolt of revenue into a state budget that is inching closer to the $50 billion milestone. The $2 billion estimate dates back to 2015.

Baker on Thursday contended that the question would not steer half of the surtax’s revenue to transportation and half to education, alleging that the funding would become “general appropriation money that people can spend on whatever they want.”

He referenced the Supreme Judicial Court’s ruling in 2018 that spiked a previous version of the question from the ballot because it improperly combined proposals to implement a graduated income tax and to direct spending toward education and transportation.

“I could be wrong about this, but my recollection is that was the main reason the SJC said that was unconstitutional, because you can’t write legislation under the Constitution,” Baker said. “You can’t say that this tax should be raised to fund these programs, that that usurps the authority of the Legislature, which is the fundamental appropriating entity.”

Both supporters and opponents say the current proposed constitutional amendment will not be subject to the same kind of legal challenges this cycle because it reached the ballot through the legislative process, rather than as a citizen-sponsored constitutional amendment.

“This is a different animal because it’s a legislative ballot initiative, not a citizens initiative petition,” Massachusetts Taxpayers Foundation President Eileen McAnneny, whose group challenged the surtax in court last time around, told the News Service.

The Associated Industries of Massachusetts, one of the other original plaintiffs alongside MTF and the Massachusetts High Technology Council, said Thursday it was not weighing another lawsuit.

With more than a year to go until voters will weigh in on the potential constitutional amendment, Baker also rebuffed the idea of proposing to use its revenue to address shortfalls at the T, saying “people shouldn’t be spending money they don’t have.”

Some of the Democrats running for Baker’s job have already woven what supporters dub the Fair Share Amendment into their policy plans. Former Sen. Ben Downing proposed using the measure’s revenue to help cover fare-free public transit and major infrastructure upgrades, and Sen. Sonia Chang-Diaz called for publicly funded preschool, expanded behavioral health services in schools and a grant program for public college tuition paid in part by the surtax.

Baker’s comments came hours after the Massachusetts Taxpayers Foundation published a report forecasting an impending financial crisis at the MBTA.

Although the T received about $2 billion in federal COVID-19 aid, report authors estimated that the MBTA will likely face persistent operating and capital budget gaps as soon as 2023.

MTF estimated that the T could need $500 million in additional annual revenues for its operating budget and $700 million to $800 million in further dedicated revenues to finance borrowing for capital projects.

“Despite all the reforms, restructuring, and revenues that have been poured into the system, you face the hard reality that the MBTA’s finances were never fundamentally fixed — ever,” MTF wrote. “You’re compelled to ask: how much longer can the T function without a complete financial overhaul?”

Ballot question backers were quick to link the dire forecast to their proposed income surtax.

“Liberal and conservative researchers agree that the MBTA needs new long-term funding to operate trains, buses, and the commuter rail without fare increases, to invest in the modern infrastructure necessary for faster, more reliable service, and to protect critical infrastructure from the effects of climate change,” said Andrew Farnitano, a spokesperson for the Raise Up Massachusetts coalition working to pass the constitutional amendment. “One-time budget surpluses and federal aid won’t be enough; Massachusetts needs a sustainable source of funding to invest in the MBTA and regional transit authorities across the state, and to repair our roads, bridges, and tunnels. The Fair Share Amendment is the answer.”

“The only ‘fiscal calamity’ facing the T is the old-school, regressive notion that riders of public transportation should be expected to pay fares,” Rep. Mike Connolly, a Cambridge Democrat, said in a tweet. “We should tax the rich and large corporations to fund public transit service, upgrades, and expansion.”

McAnneny, whose group both authored the report about the MBTA’s budget pressures and fought the income surtax question in 2018, said MTF’s findings about the T have not shifted her perspective on the constitutional amendment.

“You can support revenue for transportation and not agree that the income surtax is the way to go about it, which is our position,” she said.

Fare revenue typically makes up roughly a third of the T’s operating revenue, and a sharp decline in ridership during the pandemic exacerbated a financial outlook that had already been strained for the transit agency. In the early days of the public health crisis, ridership across all modes dropped to a fraction of previous averages, and commuters have been slow to return.

At the end of August, subway ridership was about 42 percent of August 2019 weekday averages, bus ridership was about 60 percent of the previous norm, and commuter rail ridership stood at about 30 percent of pre-pandemic levels, according to figures a T spokesperson provided Thursday.

Baker said the “biggest question on ridership” concerns how many employees return to the office and how many businesses continue to embrace hybrid or fully remote work.

He added that other funding sources remain untapped. Legislative leaders are still deciding how to spend nearly $5 billion in American Rescue Plan Act money and a sizable budget surplus, all while Washington negotiates a federal infrastructure bill that could steer substantial money to transit agencies.

“The state has a lot of resources here, and a big open question on how those resources could be and should be deployed will be driven to some extent by what happens to ridership and how we in the Legislature and others decide to spend the money that is available,” Baker said. “The federal piece is big. It’s really big. Even in the bipartisan bill, which is sort of the smallest of the infrastructure bills, it’s very significant resources to the commonwealth for transportation. I don’t think we should panic quite yet.”

(Copyright (c) 2024 State House News Service.