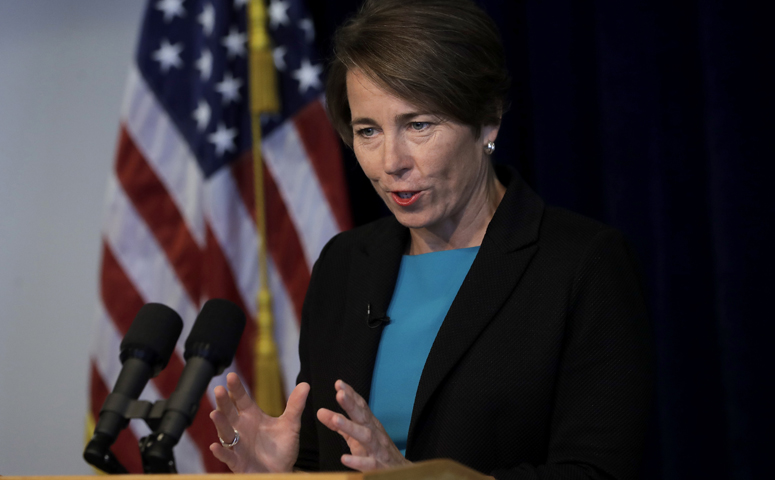

BOSTON (WHDH) - Massachusetts Attorney General Maura Healey on Friday warned debt collectors that child tax credit payments are off limits.

Under President Biden’s American Rescue Plan Act of 2021, Massachusetts residents with qualifying children have started to receive automatic monthly payments of the federal child tax credit. Residents with qualifying children should receive the first half of the value of the child tax credit through direct payments between now and the end of the year, and the remaining sum will be made available when tax forms are filed next year.

The direct payments are exempt from seizure or garnishment under Massachusetts law, according to Healey.

“These payments are critical for families to provide for their children, including many who are struggling to pay for food, childcare, and other basic costs,” Healey said in a news release. “We are issuing this guidance to put the debt collection industry on notice that these payments are off limits from seizure, and to make sure families are aware of the rights they have under law.”

Any attempt to garnish or seize the funds to collect or attempt to collect a debt violates the state’s debt collection regulations, Healey added.

(Copyright (c) 2024 Sunbeam Television. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed.)